In today’s digital world, businesses and freelancers face unprecedented risks from cyber attacks and data breaches. Whether it’s sensitive customer information, financial records, or operational systems, cyber threats can lead to financial losses, legal liabilities, and reputational damage.

For companies of all sizes, investing in professional cyber insurance has become an essential strategy. Specialized providers like KuV24-cyber.de offer tailored insurance solutions that protect against these growing risks, ensuring that businesses can operate with confidence and security.

1. The Growing Threat of Cyber Attacks

Cyber attacks are no longer limited to large corporations. Small businesses and freelancers are increasingly targeted due to weaker security systems:

- Phishing attacks and ransomware

- Data breaches exposing customer or employee information

- Malware attacks disrupting operations

- Financial fraud and online scams

Having cyber insurance helps businesses mitigate financial losses and ensures professional support in the event of an attack. KuV24-cyber.de specializes in offering protection tailored to the specific risks faced by companies and freelancers in Germany.

2. Tailored Solutions for Every Business

One of the key advantages of working with a specialized portal like KuV24-cyber.de is access to customized insurance concepts:

- Coverage designed for small, medium, and large businesses

- Policies addressing industry-specific risks

- Flexible liability and own-damage options

This ensures that your business only pays for the protection it needs, without compromising on essential coverage.

3. Comprehensive Coverage Options

Cyber insurance is not just about protecting data; it provides a safety net across multiple areas:

- Liability Coverage: Protection against third-party claims arising from data breaches or online incidents

- Own Damage Coverage: Covers financial losses directly impacting the business, such as ransom payments or IT repair costs

- Legal and Support Services: Access to expert legal and IT assistance during incidents

With complete coverage, companies can focus on growth while minimizing the financial and operational impact of cyber threats.

4. Experience Matters

Since 1990, KuV24-cyber.de has been a trusted specialist in insurance solutions. Their decades of experience allow them to:

- Analyze emerging risks in the digital landscape

- Develop insurance concepts aligned with current cyber threats

- Provide an online portal for easy policy selection and management

This expertise ensures clients receive reliable protection in an increasingly complex cybersecurity environment.

5. Importance for Freelancers and Small Businesses

Many freelancers and small businesses mistakenly believe cyber insurance is unnecessary. However, these entities are often the most vulnerable:

- Limited IT security budgets make them prime targets

- Even small breaches can lead to significant financial loss

- Professional support is essential to recover quickly and avoid reputational damage

Tailored solutions from KuV24-cyber.de make insurance accessible and effective for businesses of all sizes.

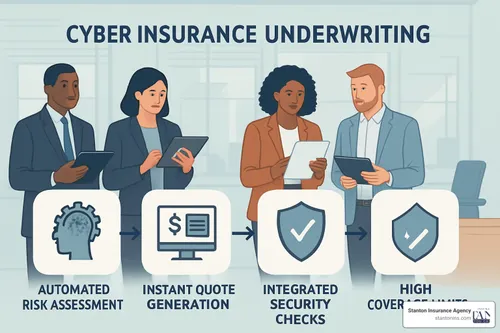

6. Fast and Easy Online Applications

One of the key benefits of KuV24-cyber.de is its specialized online application portal:

- Quickly obtain quotes for tailored insurance coverage

- Compare different policy options

- Manage your insurance directly online, saving time and hassle

This streamlined process allows businesses to secure coverage immediately, without unnecessary delays.

7. Stay Prepared in a Digital Age

To thrive in a world of constant cyber risks, businesses need proactive protection:

- Regularly review IT security measures

- Ensure all devices and systems are updated and patched

- Combine technical safeguards with professional cyber insurance

By pairing robust cybersecurity with comprehensive coverage from trusted providers like KuV24-cyber.de, companies can confidently navigate the digital landscape.

Conclusion

Cyber attacks are an ever-present threat for businesses and freelancers, regardless of size or industry. Without proper protection, financial loss, legal complications, and reputational damage can quickly escalate.

Specialized insurance providers such as KuV24-cyber.de offer tailored, comprehensive solutions to mitigate these risks, including liability, own-damage coverage, and expert support. With decades of experience and an online portal for fast applications, businesses can secure reliable protection efficiently and confidently.